Exhibit 99.1

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

1

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| ASSETS | ||||||||

| Unaudited | ||||||||

| September 30, 2021 | December 31, 2020 | |||||||

| CURRENT ASSETS: | ||||||||

| Cash | $ | 4,336,565 | $ | 36,261,104 | ||||

| Restricted Cash | 346,299 | 3,641,843 | ||||||

| Health Plan Settlement Receivables | 45,847,310 | 38,429,833 | ||||||

| Clinic Fees and Insurance Receivables, Net | 423,885 | 675,954 | ||||||

| Other Receivables | 343,583 | 146,117 | ||||||

| Prepaid Expenses and Other Current Assets | 2,525,356 | 5,192,783 | ||||||

| TOTAL CURRENT ASSETS | 53,822,998 | 84,347,634 | ||||||

| LONG-TERM ASSETS: | ||||||||

| Property, Plant and Equipment, Net | 7,921,914 | 6,150,586 | ||||||

| Goodwill and Other Intangibles | 5,885,628 | 871,128 | ||||||

| Notes Receivable, Net | 3,684,199 | 3,804,662 | ||||||

| Right of Use Asset | 7,190,501 | 4,728,242 | ||||||

| TOTAL LONG-TERM ASSETS | 24,682,242 | 15,554,618 | ||||||

| TOTAL ASSETS | $ | 78,505,240 | $ | 99,902,252 | ||||

| LIABILITIES and MEMBERS' DEFICIT | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts Payable and Accrued Expenses | $ | 15,399,853 | $ | 11,793,125 | ||||

| Accrued Payroll | 2,160,497 | 4,003,373 | ||||||

| Health Plans Settlements Payable | 13,259,118 | 13,742,775 | ||||||

| Claims Payable | 75,108,251 | 56,934,400 | ||||||

| Premium Deficiency Reserve | 4,600,000 | - | ||||||

| Accrued Interest | 8,004,450 | 4,052,406 | ||||||

| Current Portion of Long-Term Debt | 68,873 | 89,988 | ||||||

| TOTAL CURRENT LIABILITIES | 118,601,042 | 90,616,067 | ||||||

| LONG-TERM LIABILITIES: | ||||||||

| Lease Liability | 6,475,923 | 3,634,429 | ||||||

| Liability for Class D Warrants | 18,379,870 | 6,316,605 | ||||||

| Long-Term Debt | 59,358,375 | 45,387,986 | ||||||

| TOTAL LONG-TERM LIABILITIES | 84,214,168 | 55,339,020 | ||||||

| TOTAL LIABILITIES | 202,815,210 | 145,955,087 | ||||||

| Class D Units Subject to Possible

Redemption, 16,130,034 Units at $3.10 Redemption Value, Net of Issuance Costs $2,958,446, Plus Accumulated Preferred Returns of $7,895,161 and $4,567,346 at September 30, 2021 and December 31, 2020, Respectively | 54,936,716 | 51,608,900 | ||||||

| MEMBERS' DEFICIT: | ||||||||

| Contributed Capital | 41,764,270 | 41,764,270 | ||||||

| Series A Preferred Returns | 6,594,660 | 3,815,034 | ||||||

| Accumulated Equity-Based Compensation | 2,747,960 | 1,368,567 | ||||||

| Redemption of Profits Interests | (180,000 | ) | (180,000 | ) | ||||

| Retained Loss from Controlling Interests | (203,942,517 | ) | (126,242,225 | ) | ||||

| MEMBERS' DEFICIT | (153,015,627 | ) | (79,474,354 | ) | ||||

| Retained Loss from Non-Controlling Interests | (26,231,059 | ) | (18,187,381 | ) | ||||

| TOTAL MEMBERS' DEFICIT | (179,246,686 | ) | (97,661,735 | ) | ||||

| TOTAL LIABILITIES and MEMBERS' DEFICIT | $ | 78,505,240 | $ | 99,902,252 | ||||

See Accompanying Notes to Condensed Consolidated Financial Statements

2

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| OPERATING REVENUE: | ||||||||||||||||

| Capitated Revenue | $ | 152,276,992 | $ | 124,461,275 | $ | 447,137,121 | $ | 351,018,290 | ||||||||

| Other Patient Service Revenue | 4,243,263 | 4,379,716 | 12,366,111 | 9,645,990 | ||||||||||||

| TOTAL OPERATING REVENUE | 156,520,255 | 128,840,991 | 459,503,232 | 360,664,280 | ||||||||||||

| OPERATING EXPENSES (INCOME): | ||||||||||||||||

| Medical Expenses | 161,662,423 | 127,015,976 | 459,233,085 | 348,258,272 | ||||||||||||

| Premium Deficiency Reserve | 1,600,000 | 1,072,540 | 4,600,000 | (1,304,962 | ) | |||||||||||

| Corporate, General and Administrative Expenses | 20,433,538 | 13,742,904 | 53,883,267 | 36,773,545 | ||||||||||||

| Sales and Marketing Expenses | 491,418 | 278,663 | 1,118,160 | 631,073 | ||||||||||||

| Depreciation | 456,418 | 245,488 | 1,218,796 | 613,329 | ||||||||||||

| TOTAL OPERATING EXPENSES | 184,643,797 | 142,355,570 | 520,053,309 | 384,971,257 | ||||||||||||

| OPERATING LOSS | (28,123,542 | ) | (13,514,579 | ) | (60,550,077 | ) | (24,306,977 | ) | ||||||||

| OTHER INCOME (EXPENSES): | ||||||||||||||||

| Interest Expense, Net | (4,643,254 | ) | (2,316,579 | ) | (13,130,628 | ) | (6,877,619 | ) | ||||||||

| Mark-to-Market Adjustment for Class D Warrants | (1,401,686 | ) | - | (12,063,265 | ) | - | ||||||||||

| TOTAL OTHER EXPENSES | (6,044,940 | ) | (2,316,579 | ) | (25,193,893 | ) | (6,877,619 | ) | ||||||||

| NET LOSS | (34,168,482 | ) | (15,831,158 | ) | (85,743,970 | ) | (31,184,596 | ) | ||||||||

| NET LOSS ATTRIBUTABLE TO NON-CONTROLLING INTERESTS | (2,801,965 | ) | 875,560 | (8,043,678 | ) | (3,450,460 | ) | |||||||||

| NET LOSS ATTRIBUTABLE TO CONTROLLING INTERESTS | $ | (31,366,517 | ) | $ | (16,706,718 | ) | $ | (77,700,292 | ) | $ | (27,734,136 | ) | ||||

| NET LOSS PER SHARE - BASIC AND DILUTED | $ | (0.45 | ) | $ | (0.25 | ) | $ | (1.14 | ) | $ | (0.42 | ) | ||||

See Accompanying Notes to Condensed Consolidated Financial Statements

3

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN MEMBERS' DEFICIT (UNAUDITED)

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

| Class A | Class B-1 | Class C | Redemption of | Controlling | Non-Controlling | Total | ||||||||||||||||||||||||||||||||||||||

| Units | Amount | Preferred Return | Units | Amount | Units | Amount | Class C Units | Interests | Interests | Members' Deficit | ||||||||||||||||||||||||||||||||||

| MEMBERS' DEFICIT, June 30, 2021 | 43,000,000 | $ | 41,764,270 | $ | 5,632,497 | 8,000,000 | $ | 1,520,000 | 1,775,833 | $ | 872,872 | $ | (180,000 | ) | $ | (172,576,000 | ) | $ | (23,429,094 | ) | $ | (146,395,455 | ) | |||||||||||||||||||||

| Class B-1 and Class C Unit Based Compensation | - | - | - | - | - | 150,000 | 355,088 | - | - | - | 355,088 | |||||||||||||||||||||||||||||||||

| Preferred Return at 8% for Class A Units | - | - | 962,163 | - | - | - | - | - | - | - | 962,163 | |||||||||||||||||||||||||||||||||

| Net Loss | - | - | - | - | - | - | - | - | (31,366,517 | ) | (2,801,965 | ) | (34,168,482 | ) | ||||||||||||||||||||||||||||||

| MEMBERS' DEFICIT, September 30, 2021 | 43,000,000 | $ | 41,764,270 | $ | 6,594,660 | 8,000,000 | $ | 1,520,000 | 1,925,833 | $ | 1,227,960 | $ | (180,000 | ) | $ | (203,942,517 | ) | $ | (26,231,059 | ) | $ | (179,246,686 | ) | |||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

| Class A | Class B-1 | Class C | Redemption of | Controlling | Non-Controlling | Total | ||||||||||||||||||||||||||||||||||||||

| Units | Amount | Preferred Return | Units | Amount | Units | Amount | Class C Units | Interests | Interests | Members' Deficit | ||||||||||||||||||||||||||||||||||

| MEMBERS' DEFICIT, June 30, 2020 | 43,000,000 | $ | 41,764,270 | $ | 2,124,278 | 6,000,000 | $ | 1,140,000 | 1,052,083 | $ | 379,751 | $ | (180,000 | ) | $ | (96,195,133 | ) | $ | (18,206,330 | ) | $ | (69,173,164 | ) | |||||||||||||||||||||

| Class B-1 and Class C Unit Based Compensation | - | - | - | - | - | 225,000 | 52,670 | - | - | - | 52,670 | |||||||||||||||||||||||||||||||||

| Redemption of Class C Units | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||

| Preferred Return at 8% for Class A Units | - | - | 840,805 | - | - | - | - | - | - | - | 840,805 | |||||||||||||||||||||||||||||||||

| Net Income (Loss) | - | - | - | - | - | - | - | - | (16,706,718 | ) | 875,560 | (15,831,158 | ) | |||||||||||||||||||||||||||||||

| MEMBERS' DEFICIT, September 30, 2020 | 43,000,000 | $ | 41,764,270 | $ | 2,965,083 | 6,000,000 | $ | 1,140,000 | 1,277,083 | $ | 432,421 | $ | (180,000 | ) | $ | (112,901,852 | ) | $ | (17,330,770 | ) | $ | (84,110,848 | ) | |||||||||||||||||||||

| Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

| Class A | Class B-1 | Class C | Redemption of | Controlling | Non-Controlling | Total | ||||||||||||||||||||||||||||||||||||||

| Units | Amount | Preferred Return | Units | Amount | Units | Amount | Class C Units | Interests | Interests | Members' Deficit | ||||||||||||||||||||||||||||||||||

| MEMBERS' DEFICIT, December 31, 2020 | 43,000,000 | 41,764,270 | 3,815,041 | 6,000,000 | $ | 1,140,000 | 1,302,083 | $ | 228,560 | $ | (180,000 | ) | $ | (126,242,225 | ) | $ | (18,187,381 | ) | $ | (97,661,735 | ) | |||||||||||||||||||||||

| Class B-1 and Class C Unit Based Compensation | - | - | - | 2,000,000 | 380,000 | 623,750 | 999,400 | - | - | - | 1,379,400 | |||||||||||||||||||||||||||||||||

| Preferred Return at 8% for Class A Units | - | - | 2,779,619 | - | - | - | - | - | - | - | 2,779,619 | |||||||||||||||||||||||||||||||||

| Net Loss | - | - | - | - | - | - | - | - | (77,700,292 | ) | (8,043,678 | ) | (85,743,970 | ) | ||||||||||||||||||||||||||||||

| MEMBERS' DEFICIT, September 30, 2021 | 43,000,000 | $ | 41,764,270 | $ | 6,594,660 | 8,000,000 | $ | 1,520,000 | 1,925,833 | $ | 1,227,960 | $ | (180,000 | ) | $ | (203,942,517 | ) | $ | (26,231,059 | ) | $ | (179,246,686 | ) | |||||||||||||||||||||

| Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||||||

| Class A | Class B-1 | Class C | Redemption of | Controlling | Non-Controlling | Total | ||||||||||||||||||||||||||||||||||||||

| Units | Amount | Preferred Return | Units | Amount | Units | Amount | Class C Units | Interests | Interests | Members' Deficit | ||||||||||||||||||||||||||||||||||

| MEMBERS' DEFICIT, December 31, 2019 | 43,000,000 | $ | 41,764,270 | $ | 430,230 | 4,000,000 | $ | 760,000 | 1,058,333 | $ | 161,093 | $ | - | $ | (85,167,716 | ) | $ | (13,880,310 | ) | $ | (55,932,433 | ) | ||||||||||||||||||||||

| Class B-1 and Class C Unit Based Compensation | - | - | - | 2,000,000 | 380,000 | 418,750 | 271,328 | - | - | - | 651,328 | |||||||||||||||||||||||||||||||||

| Redemption of Class C Units | - | - | - | - | - | (200,000 | ) | - | (180,000 | ) | - | - | (180,000 | ) | ||||||||||||||||||||||||||||||

| Preferred Return at 8% for Class A Units | - | - | 2,534,853 | - | - | - | - | - | - | - | 2,534,853 | |||||||||||||||||||||||||||||||||

| Net Loss | - | - | - | - | - | - | - | - | (27,734,136 | ) | (3,450,460 | ) | (31,184,596 | ) | ||||||||||||||||||||||||||||||

| MEMBERS' DEFICIT, September 30, 2020 | 43,000,000 | $ | 41,764,270 | $ | 2,965,083 | 6,000,000 | $ | 1,140,000 | 1,277,083 | $ | 432,421 | $ | (180,000 | ) | $ | (112,901,852 | ) | $ | (17,330,770 | ) | $ | (84,110,848 | ) | |||||||||||||||||||||

See Accompanying Notes to Condensed Consolidated Financial Statements

4

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| Nine Months Ended September 30, | ||||||||

| 2021 | 2020 | |||||||

| Net Loss | $ | (85,743,970 | ) | $ | (31,184,596 | ) | ||

| Adjustments to Reconcile Net Loss to Cash Used in Operations: | ||||||||

| Depreciation Expense | 1,218,796 | 613,329 | ||||||

| Stock-Based Compensation | 1,379,400 | 651,329 | ||||||

| Class A and Class D Preferred Returns | 6,107,441 | 5,577,812 | ||||||

| Amortization of Discount from Issuance of Debt | 931,958 | - | ||||||

| Mark-to-Market Adjustment for Class D Warrants | 12,063,265 | - | ||||||

| Amortization of Debt Origination Fees | 525,783 | - | ||||||

| Net Change in ROU Assets and Liabilities | 379,235 | (57,496 | ) | |||||

| Premium Deficiency Reserve | 4,600,000 | (1,304,962 | ) | |||||

| Changes in Assets and Liabilities: | ||||||||

| Accounts Receivable, Net | 54,602 | (477,983 | ) | |||||

| Health Plan Settlements Receivable / Premiums Receivable | (7,417,477 | ) | (22,312,352 | ) | ||||

| Other Current Assets | 2,667,427 | (53,293 | ) | |||||

| Accounts Payable and Accrued Expenses | 3,606,729 | 5,822,494 | ||||||

| Accrued Payroll | (1,842,877 | ) | 1,644,954 | |||||

| Accrued Interest | 3,952,044 | 1,201,458 | ||||||

| Health Plan Settlements Payable | (483,657 | ) | 938,965 | |||||

| Claims Payable | 18,173,851 | 32,295,208 | ||||||

| Net Cash Used in Operations | (39,827,450 | ) | (6,645,131 | ) | ||||

| Investing Activities: | ||||||||

| Purchases of Property, Plant and Equipment | (2,990,130 | ) | (2,232,652 | ) | ||||

| Acquisitions | (5,014,500 | ) | - | |||||

| Notes Receivable, Net | 120,463 | 336,130 | ||||||

| Net Cash Used in Investing Activities | (7,884,167 | ) | (1,896,521 | ) | ||||

| Financing Activities: | ||||||||

| Issuance (Redemption) of Member Units | - | (180,000 | ) | |||||

| Issuance of Long-Term Debt | 12,750,000 | 158,134 | ||||||

| Repayment of Long-Term and Short-Term Debt | (67,216 | ) | - | |||||

| Loan Origination and Closing Fees | (191,250 | ) | - | |||||

| Net Cash Provided by (Used In) Financing Activities | 12,491,534 | (21,866 | ) | |||||

| Net Change in Cash and Restricted Cash | (35,220,083 | ) | (8,563,519 | ) | ||||

| Cash and Restricted Cash at Beginning of Period | 39,902,947 | 32,904,847 | ||||||

| Cash and Restricted Cash at End of Period | $ | 4,682,864 | $ | 24,341,328 | ||||

| Supplemental Disclosures of Cash Flow Information: | ||||||||

| Cash Paid for Interest | 1,707,705 | 312,185 | ||||||

| Accrued Costs for Internally Developed Technology (in Process) | 123,027 | - | ||||||

See Accompanying Notes to Condensed Consolidated Financial Statements

5

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Note 1: Company Operations

P3 Health Group Holdings, LLC and Subsidiaries (“P3” or “the Company” or “Holdings”) was founded on April 12, 2017 and began commercial operations on April 20, 2017 to provide population health management services on an at-risk basis to insurance plans offering medical coverage to Medicare beneficiaries under Medicare Advantage (“MA”) programs. MA programs are insurance products created solely for Medicare beneficiaries. Insurance plans contract directly with the Centers for Medicare and Medicaid Services (“CMS”) to offer Medicare beneficiaries benefits that replace traditional Medicare Fee for Service (“FFS”) coverage.

The Company’s contracts with health plans are based on an at-risk shared savings model. Under this model, the Company is financially responsible for the cost of all contractually-covered services provided to members assigned to the Company by health plans in exchange for a fixed monthly “capitation” payment, which is generally a percentage of the payment health plans receive from CMS. Under this arrangement, Medicare beneficiaries generally receive all their healthcare coverage through the Company’s network of employed and affiliated physicians and specialists (except for emergency situations).

The services provided to health plans’ members vary by contract. These may include utilization management, care management, disease education, and maintenance of a quality improvement and quality management program for members assigned to the Company. Effective January 1, 2019, the Company is also responsible for the credentialing of Company providers, processing and payment of claims and the establishment of a provider network for certain health plans. At September 30, 2021 and December 31, 2020, P3 had agreements with fourteen and twelve health plans, respectively.

The initial terms of the Company’s existing health plan contracts currently extend from periods ending December 31, 2022 through December 31, 2025. After the initial term, most health plan agreements automatically renew for various terms (usually one to two years) unless either party notifies the other, in writing, of its intent not to renew in advance based on contractually obligated notification periods. Failure of the Company to retain certain health plan contracts would have a material adverse impact on operating results.

The Company has Management Services Agreements (“MSAs”) and deficit funding agreements with Kahan, Wakefield, Abdou, PLLC and Bacchus, Wakefield, Kahan, PC (collectively, the “Network”). The MSAs provide that P3 Health Partners-Nevada, LLC will furnish administrative personnel, office supplies and equipment, general business services, contract negotiation and billing and collection services to the Network. Fees for these services are the excess of the Network’s revenue over expenses. Per the deficit agreement, P3 Health Partners-Nevada, LLC will lend amounts to the Network to the extent expenses exceed revenue(s). The loan bears interest at prime plus 2%.

In addition to P3’s contracts with health plans, through its relationship with the Network, the Company provides primary healthcare services through its employed physician clinic locations. These primary care clinics are reimbursed for services provided under FFS contracts with various payers and through capitated – per member, per month (“PMPM”) arrangements.

6

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Note 2: Significant Accounting Policies

Basis of Presentation

These accompanying, interim condensed consolidated financial statements are prepared in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) 954-205, Health Care Entities – Presentation of Financial Statements in conformity with Generally Accepted Accounting Principles in the United States of America (“GAAP”). In the opinion of Management, all material adjustments of a normal recurring nature have been made to present fairly the Company’s financial position as of September 30, 2021 and the results of operations and cash flows for the periods presented.

Principles of Consolidation

These accompanying condensed consolidated financial statements include the accounts of P3 Health Group Holdings, LLC (“Holdings”) and its six wholly-owned subsidiaries: P3 Health Group Management, LLC (“P3-MGMT”); P3 Consulting, LLC (“P3-CS”); P3 Health Partners, LLC (P3 Health Partners-Arizona, LLC, “P3-AZ”); P3 Health Partners-Nevada, LLC (“P3-NV”); P3 Health Partners-Oregon, LLC (“P3-OR”); and P3 Health Partners-Florida, LLC (“P3-FL”). P3 Health Partners ACO, LLC (Arizona Connected Care “AzCC”) is a wholly owned subsidiary of P3-AZ.

The financial statements of Kahan, Wakefield, Abdou, PLLC (“KWA”); and Bacchus, Wakefield, Kahan, PC (“BACC”) are consolidated with P3-NV. P3-NV is the primary beneficiary of these entities due to management services and deficit funding agreements in place among them, see Note 1.

On August 22, 2019, P3-AZ was assigned all the equity in AzCC for no consideration. The assets, liabilities, and operating activity of AzCC as of the assignment date are included in the Company’s condensed consolidated financial statements.

All significant transactions among these entities have been eliminated in consolidation.

Variable Interest Entities (“VIE” or “VIEs”)

Management analyzes whether (or not) the Company has any financial interests in VIEs. This analysis includes a qualitative review based on an evaluation of the design of the entity, its organizational structure, including decision making ability and financial agreements, as well as a quantitative review. ASC 810, Variable Interest Entities and Principles of Consolidation requires a reporting entity to consolidate a VIE when that reporting entity has a variable interest that provides it with a controlling financial interest in the VIE. The entity which consolidates a VIE is referred to as the primary beneficiary of the VIE. See Note 18 pertaining to VIEs.

7

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Management’s Use of Estimates

Preparation of these condensed consolidated financial statements and accompanying footnotes, in conformity with U.S. GAAP, requires Management to make estimates and assumptions that could affect amounts reported here. Management bases its estimates on the best information available at the time, its experiences and various other assumptions believed to be reasonable under the circumstances including estimates of the impact of COVID-19. The areas where significant estimates are used in these accompanying financial statements include revenue recognition, the liability for unpaid claims, unit-based compensation, premium deficiency reserves and impairment recognition of long-lived assets (including intangibles and goodwill). Actual results could differ from those estimates.

Cash and Restricted Cash

Cash includes deposits made at banks. Accounts at each institution are insured up to $250,000 by the Federal Deposit Insurance Corporation (“FDIC”). In 2021 and 2020, the Company maintained its cash in bank deposit accounts which, at times, may have exceeded FDIC insured limits. Management does not expect any losses to occur on such accounts.

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash deposits. As of September 30, 2021, and December 31, 2020, the Company had unrestricted cash of $4,336,565 and $36,261,104, respectively, deposited at banking institutions which exceeded the FDIC insured limit.

| Unaudited | ||||||||

| Type of Account | September 30, 2021 | December 31, 2020 | ||||||

| Checking | $ | 4,336,565 | $ | 36,261,104 | ||||

| Restricted | 346,299 | 3,641,843 | ||||||

| Total Cash Balances | $ | 4,682,864 | $ | 39,902,947 | ||||

Restricted Cash is that which is held for a specific purpose (such as payment of partner distributions and legal settlements) and is thus not available to the Company for immediate or general business use. Restricted Cash appears as a separate line item on the Company's condensed consolidated balance sheets.

Revenue Recognition and Revenue Sources

The following tables depict the sources (by product type) from which the Company’s revenues are derived:

| Three Months Ended September 30, | ||||||||||||||||

| Revenue Type | 2021 | % of Total | 2020 | % of Total | ||||||||||||

| Capitated Revenue | $ | 152,276,992 | 97 | % | $ | 124,461,275 | 97 | % | ||||||||

| Other Patient Service Revenue | ||||||||||||||||

| Clinical Fees & Insurance Revenue | 2,408,642 | 2 | % | 1,947,109 | 2 | % | ||||||||||

| Shared Risk Revenue | 139,331 | 0 | % | 416,765 | 0 | % | ||||||||||

| Care Coordination / Management Fees | 1,146,355 | 1 | % | 1,115,895 | 1 | % | ||||||||||

| Incentive Fees | 548,935 | 0 | % | 899,946 | 1 | % | ||||||||||

| Subtotal Other Patient Service Revenue | 4,243,263 | 3 | % | 4,379,716 | 3 | % | ||||||||||

| Total Revenue | $ | 156,520,255 | 100 | % | $ | 128,840,991 | 100 | % | ||||||||

8

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

| Nine Months Ended September 30, | ||||||||||||||||

| Revenue Type | 2021 | % of Total | 2020 | % of Total | ||||||||||||

| Capitated Revenue | $ | 447,137,121 | 97 | % | $ | 351,018,290 | 97 | % | ||||||||

| Other Patient Service Revenue | ||||||||||||||||

| Clinical Fees & Insurance Revenue | 7,280,789 | 2 | % | 4,895,956 | 1 | % | ||||||||||

| Shared Risk Revenue | 341,342 | 0 | % | 416,765 | 0 | % | ||||||||||

| Care Coordination / Management Fees | 2,994,755 | 1 | % | 2,312,840 | 1 | % | ||||||||||

| Incentive Fees | 1,749,225 | 0 | % | 2,020,429 | 1 | % | ||||||||||

| Subtotal Other Patient Service Revenue | 12,366,111 | 3 | % | 9,645,990 | 3 | % | ||||||||||

| Total Revenue | $ | 459,503,232 | 100 | % | $ | 360,664,280 | 100 | % | ||||||||

The following tables depict the individual health plans from which the Company has a concentration of revenue that is 10.0%, or more:

| Three Months Ended September 30, | ||||||||||||||||

| 2021 | % of Total | 2020 | % of Total | |||||||||||||

| Health Plan A | $ | 36,417,184 | 23 | % | $ | 35,838,768 | 28 | % | ||||||||

| Health Plan B | 38,227,530 | 24 | % | 27,666,559 | 21 | % | ||||||||||

| Health Plan C | 29,563,741 | 19 | % | 16,638,058 | 13 | % | ||||||||||

| Health Plan D | 18,913,641 | 12 | % | 21,599,026 | 17 | % | ||||||||||

| All Other | 33,398,159 | 21 | % | 27,098,580 | 21 | % | ||||||||||

| Total Revenue | $ | 156,520,255 | 100 | % | $ | 128,840,991 | 100 | % | ||||||||

| Nine Months Ended September 30, | ||||||||||||||||

| 2021 | % of Total | 2020 | % of Total | |||||||||||||

| Health Plan A | $ | 114,230,860 | 25 | % | $ | 107,265,350 | 31 | % | ||||||||

| Health Plan B | 105,261,569 | 23 | % | 80,813,324 | 22 | % | ||||||||||

| Health Plan C | 84,489,621 | 18 | % | 47,061,035 | 13 | % | ||||||||||

| Health Plan D | 56,606,725 | 12 | % | 48,750,247 | 14 | % | ||||||||||

| All Other | 98,914,457 | 22 | % | 76,774,323 | 20 | % | ||||||||||

| Total Revenue | $ | 459,503,232 | 100 | % | $ | 360,664,280 | 100 | % | ||||||||

Revenue Recognition

The Company applies the framework prescribed according to ASC 606, Revenue from Contracts with Customers (“ASC 606”), to recognize revenue. The core principle of ASC 606 is that an entity’s performance obligation is complete, and revenue is earned, upon the transfer of a promise to deliver services to customers commensurate with consideration to which it would expect to be received in exchange for the actual delivery of those services. The terms of the contract and all relevant facts and circumstances should be considered when applying this guidance. This includes application of a practical expedient (a “portfolio approach”) to contracts with similar characteristics and circumstances. P3 used the portfolio approach to account for any ASC 606 transition adjustments for revenue from its MA contracted health plans.

9

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

The principles of ASC 606 are generally applied using the following five steps:

| 1. | Identify the contract(s) with a customer. |

| 2. | Identify the performance obligations in the contract. |

| 3. | Determine the transaction price. |

| 4. | Allocate the transaction price to the performance obligations in the contract; and |

| 5. | Recognize revenue when (or as) the entity satisfies a performance obligation. |

The guidance requires disclosures related to the nature, amount, timing, and uncertainty of revenue that is recognized. The Company initially applied the standard on January 1, 2019, using the modified retrospective adoption method, and elected to apply the modified retrospective method only to contracts that were not completed as of this date. This modified retrospective application did not have a material impact on the Company’s December 31, 2018 retained earnings (deficit). Additionally, the Company utilized the portfolio approach to group contracts together with similar characteristics for the adoption analysis.

Capitated Revenue

The Company contracts with health plans using an at-risk (shared savings) model. Under the at-risk model, P3 is responsible for the cost of all covered services provided to members assigned by the health plans to the Company in exchange for a fixed payment, which generally is a percentage of the payment (“POP”) based on health plans’ premiums received from CMS. Through this capitation arrangement, P3 stands ready to provide assigned MA beneficiaries all their medical care via the Company’s directly employed and affiliated physician/specialist network.

The premiums health plans receive are determined via a competitive bidding process with CMS and are based on the costs of care in local markets and the average utilization of services by patients enrolled. Medicare pays capitation using a “risk adjustment model”, which compensates providers based on the health status (acuity) of each individual patient. MA plans with higher acuity patients receive higher premiums. Conversely, MA plans with lower acuity patients receive lesser premiums. Under the risk adjustment model, capitation is paid on an interim basis based on enrollee data submitted for the preceding year and is adjusted in subsequent periods after final data is compiled. As premiums are adjusted via this risk adjustment model (via a Risk Adjustment Factor, “RAF”), the Company’s PMPM payments will change commensurately with how our contracted MA plans’ premiums change with CMS. Management determined the transaction price for these contracts is variable as it primarily includes PMPM fees which can fluctuate throughout the course of the year based on the acuity of each individual enrollee. Capitated accounts receivable includes $301,602 and $1,174,916 as of September 30, 2021 and December 31, 2020, respectively, for acuity-related adjustments that are estimated to be received in subsequent periods. These amounts are included in Health Plan Settlement Receivables. In certain contracts, PMPM fees also include adjustments for items such as performance incentives or penalties based on the achievement of certain clinical quality metrics as contracted with payors.

10

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Capitated revenues are recognized based on an estimated PMPM transaction price to transfer the service for a distinct increment of the series (e.g. month) and is recognized net of projected acuity adjustments and performance incentives or penalties as Management can reasonably estimate the ultimate PMPM payment of those contracts. The Company recognizes revenue in the month in which eligible members are entitled to receive healthcare benefits during the contract term. The capitation amount is subject to possible retroactive premium risk adjustments based on the member’s individual acuity. As the period between the time of service and time of payment is typically one year or less, Management elected the practical expedient under ASC 606-10-32-18 and did not adjust for the effects of a significant financing component.

P3’s contracts with health plans may include core functions and services for managing assigned patients’ medical care. The combination of those services is offered as one “single solution” (“bundle”). The Company does not offer nor price each individual function as a standalone a la carte service to health plans. However, the addition or exclusion of certain services may be negotiated and reflected in each health plan’s specific total POP.

As of September 30, 2021, and December 31, 2020, P3 had POP contracts in effect with fourteen and twelve health plans (both across four states), respectively.

11

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Each month, in accordance with contractual obligations (for non-delegated health plans, e.g. – those for which the Company has not been delegated for claims processing), each plan funds a medical claims payment reserve equal to a defined percentage of premium attributable to members assigned P3. In turn, P3 administers and funds medical claims for contractually covered services, for assigned health plan members, from that health plan’s reserve. On a quarterly or monthly basis, health plans conduct a settlement of the reserve to determine any surplus or deficit amount. The reconciliation and distribution of the reserve occur within 120-days following the end of each quarter. An annual settlement reconciliation and distribution from all funds occurs within twenty-one months following each year-end. At September 30, 2021 and December 31, 2020, settlement receivables (health plan surpluses) and settlement payables (health plan deficits), by health plan, by period, were as follows:

| Health Plan Name | September 30, 2021 | December 31, 2020 | ||||||

| Health Plan A | $ | 838,428 | $ | 94,501 | ||||

| Health Plan B | 18,853,480 | 15,766,808 | ||||||

| Health Plan C | 9,010,871 | 7,332,687 | ||||||

| Health Plan D | 7,933,506 | 6,863,270 | ||||||

| Health Plan E | 1,135,398 | 1,429,722 | ||||||

| Health Plan F | 3,236,511 | 3,222,247 | ||||||

| Health Plan G | 239,375 | 2,748,622 | ||||||

| Health Plan H | 2,124,913 | 428,755 | ||||||

| Health Plan I | 250,591 | 17,908 | ||||||

| Health Plan J | 136,586 | 141,922 | ||||||

| Health Plan K | - | 4,569 | ||||||

| Health Plan L | 174,859 | 378,822 | ||||||

| Health Plan N | 1,912,792 | - | ||||||

| Total Health Plan Settlement Receivables | $ | 45,847,310 | $ | 38,429,833 | ||||

| Health Plan Name | September 30, 2021 | December 31, 2020 | ||||||

| Health Plan C | $ | 191,179 | $ | 1,928,414 | ||||

| Health Plan D | 4,680,185 | 4,680,185 | ||||||

| Health Plan F | 7,294,784 | 6,125,681 | ||||||

| Health Plan G | 703,095 | 1,008,495 | ||||||

| Health Plan I | 166,956 | - | ||||||

| Health Plan M | 222,919 | - | ||||||

| Total Health Plan Settlement Payables by Year | $ | 13,259,118 | $ | 13,742,775 | ||||

At September 30, 2021, and December 31, 2020, Management has deemed the Company’s settlement receivables to be fully collectible from those health plans where P3 is not delegated for claims processing. Accordingly, an allowance for doubtful accounts is not necessary.

Other Patient Service Revenue(s) – Clinical Fees and Insurance Revenue

Clinic fees and insurance revenues relate to net patient fees received from various payers and direct patients (“self-payers”) under contracts in which P3’s sole performance obligation is to provide healthcare services through the operation of medical clinics. The Company recognizes clinic fees and insurance revenue in the period in which services are provided, on the date of service, under FFS payment arrangements or in the month assigned health plan members are entitled to services. P3’s performance obligations are typically satisfied in the same day services are provided. All the Company’s contracts with its customers under these arrangements include a single performance obligation.

12

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

P3’s contractual relationships with patients, in most cases, also involve third-party payers (Medicare, Medicaid, managed care health plans and commercial insurance companies, including plans offered through state-sponsored health insurance exchanges). Transaction prices for services provided are dependent upon specific rules in place with third party payers – specifically, Medicare/Medicaid and pre-negotiated rates with managed care health plans and commercial insurance companies. Contractual arrangements with third parties typically include payments at amounts which are less than standard charges. These charges generally have predetermined rates for diagnostic service codes or discounted FFS rates. Management perpetually reviews P3’s contractual estimation processes to consider and incorporate updates to laws, regulations and frequent changes in the managed care system. Contractual terms are negotiated and updated accordingly upon renewal.

The Company’s revenue is based upon the estimated amounts Management expects to receive from patients and third-party payers. Estimates of explicit price concessions under managed care and commercial insurance plans are tied to payment terms specified in related contractual agreements. Retroactively calculated explicit price concessions tied to reimbursement agreements with third-party payers are recognized on an estimated basis in the period related services are rendered and adjusted in future periods as final payments are received. Revenue related to uninsured patients, uninsured co-payments, and deductibles (for patients with healthcare coverage) may also be discounted. P3 records implicit price concessions (based on historical collection experience) related to uninsured accounts to recognize self-pay revenues at their most likely amounts to be collected.

As part of the adoption of ASC 606, Management elected two of the available practical expedients provided for by the standard. First, the Company did not adjust the transaction price for any financing components as those were deemed to be insignificant. Additionally, the Company expensed all incremental customer contract acquisition costs as incurred as such costs are not material and would be amortized over a period less than one year.

Other Patient Service Revenue(s) – Shared Risk Revenue

The Company (via one of its wholly owned subsidiaries – Arizona Connected Care, “AzCC”) receives 30% of the shared risk savings from parties with whom it contracts under four separate arrangements. These arrangements are driven solely by medical cost containment year-over-year (“YoY”) expense reductions. This key performance indicator (“KPI”) is measured by the aggregate change in PMPY (per member, per year medical costs. If the sequential YoY PMPY aggregate change yields a reduction, the Company receives 30% of the associated total cost savings for that year. Conversely, if the sequential YoY PMPY aggregate change yields an increase in medical costs, no monies are due the Company that year. This KPI is compiled and reviewed on a calendar year basis.

Other Patient Service Revenue(s) – Care Coordination Fees and Management Fees

P3’s delegated health plans may also pay a Care Coordination Fee (“CCF”) or Management Fee to the Company. CCFs and Management Fees are intended to fund the costs of delegated services provided to certain health plans. CCFs are specifically identified and separated in each monthly capitation payment the Company receives from these parties. None of the Company’s other health plans bifurcate CCFs nor are any of them contractually required to do so.

13

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

The Company uses a portfolio approach to account for CCFs and Management Fees. Based on similarities of the terms of the care coordination and administrative services, Management believes that revenue recognized by utilizing the portfolio approach approximates that which it would have realized if an individual contract approach were applied.

Other Patient Service Revenue(s) – Incentive Fees

Certain health plans with whom the Company contracts pay incentives to P3 when KPIs are positive and exemplary. KPIs may include high patient satisfaction; extraordinary quality of care; P3’s contribution to health plans’ Star Rating(s); and P3’s net promoter score (“NPS”) – among a variety of others. Incentive Fees are realized upon the Company’s receipt of cash, as the amounts are constrained by the discretion of health plans.

Patient Fees Receivable

Substantially, all client fees and insurance receivables are due under FFS contracts with third party payors, such as commercial insurance companies (“Commercial”), government-sponsored healthcare programs (“Medicare/Medicaid”) or directly from patients (“Self-Pay”). Management continuously monitors activities from payors (including patients) and records an estimated price concession based on specific contracts and actual historical collection patterns. Patient fees receivable, where a third-party payor is responsible for the amount due, are carried at amounts determined by the original charges for services provided less explicit price concessions. Price concessions represent amounts made for contractual adjustments (discounts). Patient fees receivable are included in Clinic Fees and Insurance Receivables in the Company’s Condensed Consolidated Balance Sheets and are recorded net of contractual allowances.

Patient fees receivable are recorded at the invoiced amount, net of any expected contractual adjustments and implicit price concessions, and do not bear interest. The Company has agreements with third-party payors that provide for payments at amounts different from the established rates. Payment arrangements include prospectively determined rates per discharge, reimbursed costs, discounted charges, and per diem payments. Patient service revenues are reported at the estimated net realizable amounts from patients, third-party payors, and others for services rendered. Contractual adjustments arising under reimbursement arrangements with third-party payors are accrued on an estimated basis in the period the related services are rendered and are adjusted in future periods as final settlements are determined. Implicit price concessions are taken based on historical collection experience and reflect the estimated amounts the Company expects to collect.

Property, Plant and Equipment (“PP&E”)

PP&E is carried at acquisition cost, net of accumulated depreciation. Costs for repairs and maintenance of PP&E, after such PP&E has been placed in service, are expensed as incurred. Costs and related accumulated depreciation are eliminated when PP&E is sold or otherwise disposed. Sales and disposals may result in asset-specific gains or losses. Any such gains or losses are included as a component to net income (loss). Management computes and records depreciation using the straight-line method. The following table summarizes the estimated useful lives applicable to PP&E:

14

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

| Classification PP&E Asset | Depreciation Cycle | |

| Leasehold Improvements (Cycle: Lease Term) | Lease Term | |

| Furniture & Fixtures | 7-Years | |

| Computer Equipment | 3-Years | |

| Medical Equipment | 7-Years | |

| Software | 3-Years | |

| Software (Development in Process) | N/A |

ASC 350-40, Accounting for Internal Use Software, outlines how companies should capitalize or expense internal-use software, based on achieving two key objectives. The first objective includes ensuring that the Preliminary Project Stage has been completed and the second one being the type of work being completed within the Application Development Stage, which qualifies as a capitalizable activity.

Computer software is considered for internal use when it is developed or purchased for the internal usage and needs of the organization only.

Beginning in 2018, P3 began the project build of its own proprietary technology to serve core functions of its business operations such as revenue and medical cost analysis, care management and various facets that promote impactful utilization. At September 30, 2021 and December 31,2020, the Company has categorized $2,272,560 and $2,794,221, respectively to Property, Plant and Equipment (“PP&E”) for these software costs (specifically to work in progress).

P3’s internally-developed technology has been and is continuing to be designed to standardize the availability of quality data used across the enterprise. The technology requires several components of external input from health plans served by P3, its provider network and member-patient populations.

As internally developed technology is deemed “substantially complete”, it is placed into service and depreciated. At September 30, 2021, and December 31, 2020, $2,411,278 and $534,931, of capitalized costs was placed into service, respectively. Any, and all, costs associated with internally developed technology, following deployment are expensed directly to the Company’s Condensed Consolidated Statements of Operations, as incurred.

Impairment of Long-Lived Assets

In accordance with ASC 360, Property, Plant, and Equipment (“PP&E”) – Impairment or Disposal of Long-Lived Assets, the Company reviews its long-lived assets for impairment whenever events or changes in circumstances indicate their carrying amounts may not be recoverable. Recoverability of an asset or asset group is measured by comparing its’ carrying amount to the future undiscounted net cash flows the asset or asset group is expected to generate. If such assets are considered impaired (e.g. – future undiscounted cash flows are less than net book value), an impairment charge is recognized. Assets to be disposed of are reported at the lower of the carrying amount or fair value less costs to sell. To date, the Company has not retired nor sold any PP&E.

15

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Goodwill

In accordance with ASC 350, Goodwill and Other – Accounting for Goodwill, Management has elected to test goodwill for impairment at the Company level. Goodwill is tested for impairment on, at least, an annual basis or more frequently if a known triggering event occurs. If a triggering event occurs, the fair value of goodwill may decrease below its’ carrying amount. On the occurrence of a triggering event, an entity has the option to first assess qualitative factors at the “macro” level (Step 0) to determine whether a quantitative impairment test (Step 1) is necessary. If Step 0 indicates it’s more likely than not that goodwill is impaired, Management must proceed with Step 1 to quantify the current fair value differential below the carrying amount. If the qualitative assessment indicates it’s more likely than not that goodwill is not impaired, no further testing is needed. The Company has not recorded any goodwill impairment charges in 2020 or 2021.

Leases

The Company accounts for its leases under ASC 842 Leases. In accordance with ASC 842, the Company, at the inception of the contract, determines whether a contract is or contains a lease. For leases with terms greater than 12 months, the Company records the related operating or finance right of use asset and lease liability at the present value of lease payments over the lease term. The Company is generally not able to readily determine the implicit rate in the lease and therefore uses the determined incremental borrowing rate at lease commencement to compute the present value of lease payments. The incremental borrowing rate represents an estimate of the market interest rate the Company would incur at lease commencement to borrow an amount equal to the lease payments on a collateralized basis over the term of a lease. Renewal options are not included in the measurement of the right of use assets and lease liabilities unless the Company is reasonably certain to exercise the optional renewal periods. Some leases also include early termination options, which can be exercised under specific conditions. Additionally, certain leases contain incentives, such as construction allowances from landlords. These incentives reduce the right-of-use asset related to the lease.

Some of the Company's leases contain rent escalations over the lease term. The Company recognizes expense for operating leases on a straight-line basis over the lease term. The Company does not currently have any finance leases. The Company’s lease agreements contain variable payments for common area maintenance and utilities. The Company has elected the practical expedient to combine lease and non-lease components for all asset categories. Therefore, the lease payments used to measure the lease liability for these leases include fixed minimum rentals along with fixed non lease component charges. The Company does not have significant residual value guarantees or restrictive covenants in its lease portfolio.

Business Combinations

In accordance with ASC 805, Business Combinations, the price tendered in business acquisitions is allocated among the identifiable tangible and intangible assets and assumed liabilities - all of which are based on estimates of corresponding fair value as of the acquisition date. Management applies valuation methods which are ultimately used in the Company’s purchase price allocations. Goodwill is recorded based on the difference between the fair value of consideration exchanged and the fair value of the net assets and liabilities assumed.

16

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Equity-Based Compensation

Under P3’s unit-based incentive plan, the Company may reward grantees with various types of awards, including but not limited to profits interests on a service-based or performance-based schedule. These awards may also contain market conditions.

For performance-vesting units, P3 recognizes unit-based compensation expense when it is probable that the underlying performance condition will be achieved. The Company will analyze if a performance condition is probable for each reporting period through the settlement date for awards subject to performance vesting.

For service-vesting units, P3 recognizes unit-based compensation expense over the requisite service period for each separately vesting portion of the profits interest as if the award was, in substance, multiple awards. Some service awards vest monthly whereby the Company recognizes associated compensation expense in equal installments throughout the course of the year.

The Company’s Management Incentive Plan, which became effective as of December 8, 2017 and which P3’s Board of Managers, (the “Board”) amended and restated on April 16, 2020 (the “Incentive Plan”), provides for the grant of service-based and performance-based incentive units to certain officers, directors, and employees. Subject to adjustment, a maximum aggregate of 6,845,297 incentive units are authorized for issuance under the Incentive Plan. Incentive unit awards are governed by the terms of the Incentive Plan, the terms of the award agreement documenting the grant and the limited liability company agreement of P3 Health Group Holdings, LLC (the “LLC Agreement”), and are intended to qualify as a “profits interest” for Federal income tax purposes.

Warrant Liability

The Company accounts for warrant units of the Company’s Class D Units that may become redeemable for cash or other assets as liabilities at fair value on the Condensed Consolidated Balance Sheets. The warrants are subject to remeasurement at each balance sheet date and any change in fair value is recognized in the Company’s Condensed Consolidated Statements of Operations. Changes in the estimated fair value of the warrants are recognized as a non-cash gain or loss. The fair value of the warrants was estimated using an Option Pricing model (Black-Scholes-Merton).

The Company utilizes the Black-Scholes-Merton methodology to value the warrants at each reporting period, with changes in fair value recognized in the Condensed Consolidated Statements of Operations. The estimated fair value of the warrant liability is determined using Level 1 and Level 3 inputs. The key assumptions used in the option pricing model relate to expected share-price volatility, expected term, and the risk-free interest rate. The expected volatility was derived from the asset volatilities of a selected group of comparable public companies. The risk-free interest rate is based on U.S. Treasury zero coupon bond rates. The expected term of the warrants is assumed to be the time until the close of the Transaction discussed in Note 19.

17

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

The key inputs into the option pricing model at September 30, 2021, and December 31, 2020 were as follows:

| Key Input | September 30, 2021 | December 31, 2020 | ||||||

| Volatility | 60.00 | % | 65.00 | % | ||||

| Risk-Free Interest Rate | 0.09 | % | 0.10 | % | ||||

| Exercise Price | $ | 4.68 | $ | 4.68 | ||||

| Expected Term | 1.0 Years | 1.1 Years | ||||||

Premium Deficiency Reserve (“PDR”)

In accordance with ASC 944-60-25-4, a PDR is required when there is a probable loss on unearned premiums. PDR is recognized when the unearned premium reserve is insufficient to cover the existing books of business. If a PDR exists, the amount shall be recognized by recording an additional liability for the deficiency with a corresponding charge to operations. As of September 30, 2021, the Company had accrued a $4,600,000 PDR to its Condensed Consolidated Balance Sheet.

Healthcare Services Expense and Claims Payable (collectively, “Medical Expenses”)

The cost of healthcare services is recognized in the period services are provided. This also includes an estimate of the cost of services that have been incurred, but not yet reported (“IBNR”). Medical expenses also include costs for overseeing the quality of care and programs, which focus on patient wellness. Additionally, healthcare expenses can also include, from time to time, remediation of certain claims that might result from periodic reviews conducted by various regulatory agencies.

A reserve for unpaid health claims is reported as IBNR. IBNR is based on historical paid claims trends and healthcare utilization metrics and available industry data. IBNR is recorded as “Claims Payable” in the accompanying condensed consolidated balance sheets. The Company recorded $75,108,251 and $56,934,400 of IBNR liabilities to its Condensed Consolidated Balance Sheets at September 30, 2021 and December 31, 2020, respectively.

Management estimates the Company’s IBNR by applying standard actuarial methodologies, which utilize historical data, including the period between the date services are rendered and the date claims received (and paid), denied claims activity, expected medical cost inflation, seasonality patterns, and changes in membership mix. IBNR estimates are made on an accrual basis and adjusted in future periods as required. Any adjustments to prior period estimates are included in the current period. Such estimates are subject to the impact from changes in both the regulatory and economic environments. The Company’s claims payable represents Management’s best estimate of its liability for unpaid medical costs as of September 30, 2021 and December 31, 2020.

Income

Taxes

The Company and its wholly owned subsidiaries are “Single Member” limited liability companies (“LLCs”) and, therefore,

do not directly pay Federal income tax expense(s), except for P3 Health Group Management, LLC (“P3-MGMT”), which has elected

to file as a C-Corp under the Internal Revenue Code. However, P3-MGMT – although subject to Federal income tax, has historically

not paid any such taxes due to loss carryforwards.

18

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Management evaluates the Company’s potential for any uncertain tax positions. This is done on a continual basis throughout the course of the year. This is accomplished through a review of policies and procedures, reviews of customary and regular tax filings, and discussions with third-party experts. The Company did not have any uncertain tax positions at September 30, 2021 nor December 31, 2020.

As an LLC, the Company files annual Federal partnership income tax returns in the United States and in and in certain states and local jurisdictions. No returns are closed to assessment based on the inception date of the Company (2017). Interest and penalties, if any, would be recorded as a component of operating expenses.

Sales and Marketing Expenses

The Company uses advertising primarily to promote the health plans with whom it conducts business as well as its physician clinics throughout the geographic areas it serves. Advertising costs are charged directly to operations as incurred. Sales and Marketing Expenses totaled $491,418 and $278,663 for the three months ended September 30, 2021 and 2020, respectively. Sales and Marketing Expenses totaled $1,118,160 and $631,073 for the nine months ended September 30, 2021 and 2020, respectively.

Note 3: Recent Accounting Pronouncements Not Yet Adopted

In October 2018, the FASB issued ASU 2018-17, Consolidation – Targeted Improvements to Related Party Guidance for Variable Interest Entities (Topic 810) (“ASU 2018-17”). ASU 2018-17 eliminates the requirement that entities consider indirect interests held through related parties under common control in their entirety when assessing whether a decision-making fee is a variable interest. Instead, the reporting entity will consider such indirect interests on a proportionate basis. ASU 2018-17 is effective for the Company for fiscal years beginning after December 15, 2020, and interim periods within fiscal years beginning after December 15, 2021. All entities are required to apply the adjustments in ASU 2018-17 retrospectively with a cumulative-effect adjustment to retained earnings at the beginning of the earliest period presented. Early adoption is permitted. The Company is currently evaluating the impact this standard will have on its condensed consolidated financial statements and related disclosures.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”). ASU 2016-13 introduces a new model for recognizing credit losses on financial instruments based on an estimate of current expected credit losses. The guidance is effective the Company beginning January 1, 2023. The new current expected credit losses (“CECL”) model generally calls for the immediate recognition of all expected credit losses and applies to loans, accounts and trade receivables as well as other financial assets measured at amortized cost, loan commitments and off-balance sheet credit exposures, debt securities and other financial assets measured at fair value through other comprehensive income, and beneficial interests in securitized financial assets. The new guidance replaces the current incurred loss model for measuring expected credit losses, requires expected losses on available for sale debt securities to be recognized through an allowance for credit losses rather than as reductions in the amortized cost of the securities, and provides for additional disclosure requirements. The Company is currently evaluating the impact the adoption of this standard will have on its condensed consolidated financial statements.

19

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Note 4: Company Liquidity, Operations and Management’s Plans

The Company follows guidance promulgated by the FASB, specifically, ASC 205-40, Presentation of Financial Statements – Going Concern, which requires Management to assess P3’s ability to continue as a going concern and to provide related disclosure(s) in certain circumstances.

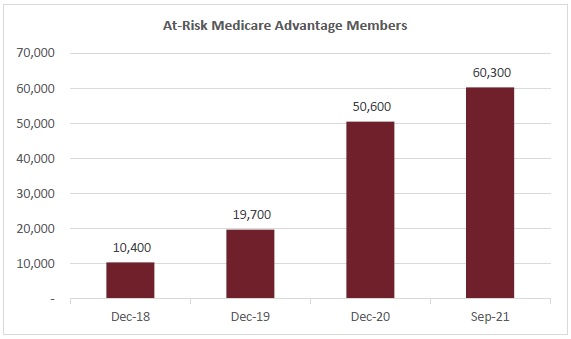

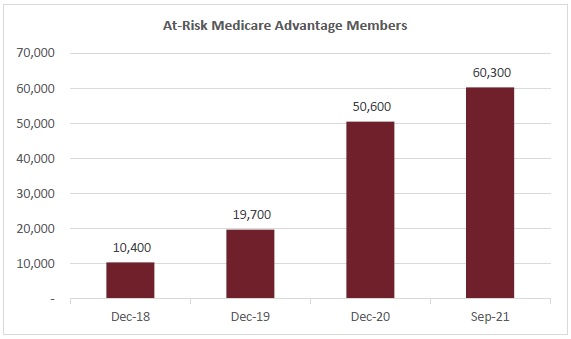

The Company has experienced revenue growth in 2019, 2020 and the nine months ended September 30, 2021 due to contracting with six new health plans in 2019, five additional new health plans in 2020, and two additional health plans in 2021.

| Year | # Health Plans | Revenue | YoY Growth | Net Loss | Net Loss % | ||||||||||||||||

| 2018 | 1 | $ | 87,696,695 | N/A | $ | (49,774,013 | ) | -56.8 | % | ||||||||||||

| 2019 | 7 | 145,894,832 | 66 | % | (42,916,855 | ) | -29.4 | % | |||||||||||||

| 2020 | 12 | 485,541,288 | 233 | % | (45,381,578 | ) | -9.3 | % | |||||||||||||

| September 2020 YTD | 12 | 360,664,280 | N/A | (31,184,596 | ) | -8.6 | % | ||||||||||||||

| September 2021 YTD | 14 | 459,503,232 | 27 | % | (85,743,970 | ) | -18.7 | % | |||||||||||||

On November 19, 2020, the Company entered a Term Loan Agreement with CRG Servicing, LLC (“CRG”) (the “Agreement”) to provide additional Net Working Capital (“NWC”) of up to $100.0 million limited to three total and tri-annual draws ($40.0 million in year 1, $35.0 million in year 2 and $25.0 million in year 3). Draws totaling $52.8 million have been made ($40.0 million in 2020, year 1, and $12.8 million in 2021, year 2) as of September 30, 2021. Per the terms of the Agreement, the Company may draw down an additional $47.2 million of funding from CRG – limited to $22.2 million in 2021 (year 2) and $25.0 million in 2022 (year 3).

The Company’s Agreement with CRG requires compliance with certain financial covenants. Financial covenants require the Company to always maintain minimum liquidity, as defined in the agreement, of $5.0 million and annual consolidated revenue of, at least, $395.0 million for 2021. Although the Company’s revenue covenant is annual, P3 posted consolidated revenue of $459.5 million in the nine months ended September 30, 2021. For certain days in September 2021, minimum liquidity for the Company, as defined in the Agreement, fell below $5.0 million. The Company has obtained a waiver of the debt covenant violation that occurred on those days. Also, upon close of the Transaction referenced in Note 19, the Company expects to receive $180.0 million in net proceeds, which will be used to fund its operations and working capital.

The Company believes it has sufficient, and available, cash resources to continue operating as a going concern and to be compliant with its debt covenants over the next 12-month period.

20

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

As the Company continues to pursue its business plan, it may need to finance its operations through a combination of public or private equity or debt financings or other capital sources. However, there can be no assurance that any additional financing or strategic transactions will be available to the Company on acceptable terms, if at all. If events or circumstances occur such that the Company does not obtain additional funding, this could have a material adverse effect on the Company’s business, results of operations or financial condition.

Note 5: Patient Fees Receivable

Patient fees receivable is included in Clinic Fees and Insurance Receivables in the Company’s Condensed Consolidated Balance Sheets and consisted of the following categories for each of the periods ended September 30, 2021 and December 31, 2020, presented below:

| Unaudited | ||||||||

| September 30, 2021 | December 31, 2020 | |||||||

| Total Receivables: Gross | $ | 2,098,575 | $ | 662,526 | ||||

| Less: Contractual Allowances | (1,799,004 | ) | (302,137 | ) | ||||

| Receivables Net of Contractual Allowances | 299,571 | 360,389 | ||||||

| Commercial | 129,742 | 203,201 | ||||||

| Medicare / Medicaid | 147,635 | 109,996 | ||||||

| Self Pay | 22,194 | 47,192 | ||||||

| Receivables Net of Contractual Allowances | $ | 299,571 | $ | 360,389 | ||||

Note 6: Property, Plant and Equipment (“PP&E”)

The Company’s PP&E balances as of September 30, 2021 and December 31, 2020 consisted of the following:

| Unaudited | ||||||||

| Classification PP&E Asset | September 30, 2021 | December 31, 2020 | ||||||

| Leasehold Improvements (Cycle: Lease Term) | $ | 2,135,982 | $ | 1,392,688 | ||||

| Furniture & Fixtures | 1,511,151 | 1,150,789 | ||||||

| Computer Equipment & Software | 4,234,995 | 1,947,894 | ||||||

| Medical Equipment | 578,849 | 457,822 | ||||||

| Software (Development in Process) | 2,272,560 | 2,794,221 | ||||||

| Less: Accumulated Depreciation | (2,811,623 | ) | (1,592,827 | ) | ||||

| Totals | $ | 7,921,914 | $ | 6,150,587 | ||||

Note 7: Business Acquisitions

The Company makes acquisitions to expand its geographical footprint and member base. The following acquisitions have been accounted for as business combinations.

The amounts presented for the 2021 acquired Intangible Assets are based on their estimated fair value at the date of acquisition. These estimates, and their corresponding amortization expense will be finalized by December 31, 2021.

21

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Michael F. Hamant, M.D., P.C.

On October 30, 2020, the Company purchased a medical practice, Michael F. Hamant, M.D., P.C. The purchase price totaled $140,000 paid in cash, $20,000 of which was for transaction fees.

The total purchase price has been allocated to PP&E and Goodwill. The following table provides an allocation of the total purchase price:

| Goodwill | $ | 130,000 | ||

| PP&E | 10,000 | |||

| Total Purchase Price | $ | 140,000 |

Robert E. Mutterperl, D.O., S.C.

On April 5, 2021, the Company purchased a medical practice, Robert E. Mutterperl, D.O., S.C. The purchase price totaled $85,000 paid in cash, $3,000 of which was for transaction fees.

$82,000 of the total purchase price has been allocated to Goodwill.

Neisa I. Diaz, M.D., LLC

On July 1, 2021, the Company purchased a medical practice, Neisa I. Diaz, M.D. LLC. The total purchase price was $3,802,037, which was paid in cash. The total purchase price has been allocated to Acquired Intangibles (representing the present value of existing payor contracts, with an estimated economic life of 10 years), other assets and goodwill. The following table provides a preliminary allocation of the total purchase price:

| Aquired Intangibles | $ | 1,840,000 | ||

| Goodwill | 1,960,000 | |||

| Other Assets | 2,037 | |||

| Total Purchase Price | $ | 3,802,037 |

Medical Associates of Tampa Bay, LLC

On September 3, 2021, the Company purchased a medical practice, Medical Associates of Tampa Bay, LLC. The total purchase price was $1,154,000, which was paid in cash. The total purchase price has been allocated to acquired intangible assets (representing the present value of payor contracts, with an estimated economic life of 10 years), PP&E, and Goodwill. The following table provides a preliminary allocation of the total purchase price:

| Aquired Intangibles | $ | 240,000 | ||

| Goodwill | 892,550 | |||

| PP&E | 21,450 | |||

| Total Purchase Price | $ | 1,154,000 |

22

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

A summary of Goodwill and Other Intangibles is as follows:

| September 30, 2021 | December 31, 2020 | |||||||

| Goodwill | $ | 3,805,628 | $ | 871,128 | ||||

| Intangible Assets - Amortizable | 2,080,000 | - | ||||||

| Total | $ | 5,885,628 | $ | 871,128 | ||||

Note 8: Notes Receivable, Net

The Company entered into five Promissory Notes (the “Notes”) with three family medical practices (the “Practices”) to fund working capital needs. The Company simultaneously entered separate Provider Agreements with each Practice related to four of these five Notes. Each Provider Agreement establishes a preferred, predetermined reimbursement rate for services rendered to the Company’s members and requires that Practice to furnish healthcare services to the Company’s members. The Provider Agreements mature in concert with each practice’s loan. In accordance with each of these four Notes, so long as the corresponding Provider Agreement is in effect on the maturity date of each Note and has not been terminated by the borrower for any reason, the Company will forgive the entire principal, plus accrued interest due on the date of maturity. Likewise, if the Company terminates the Provider Agreement prior to maturity without cause, all principal plus accrued interest due from the borrower will be forgiven. Upon early termination of the Provider Agreement by borrower, all principal and accrued interest will become immediately payable and due the Company. Related to potential forgiveness, the Company records a valuation allowance on a straight-line basis following the early termination date through the date of maturity, due to the probable likelihood of needing to forgive the notes at maturity, with a full valuation allowance set at the time of maturity.

At September 30, 2021 and December 31, 2020, the Company has recorded notes receivable of $4,027,598 and $4,000,629, including accrued interest of $795,318 and $572,382, and net of valuation allowances of $343,399 and $195,967, respectively. The Notes carry maturity dates ranging from December 31, 2021 through December 31, 2028 with interest rates ranging from 5.0% to 10.0%. The short-term components, $343,399 and $174,499, as of September 30, 2021 and December 31, 2020, of these Notes is included in Other Receivables in the Company’s Condensed Consolidated Balance Sheets.

23

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

Note 9: Claims Payable

Claims payable includes claims reported as of the balance sheet date, including estimates for IBNR, due to third parties for health care services provided to members. IBNR was $75,108,251 and $54,472,498 at September 30, 2021 and 2020, respectively. Activity in the liability for claims payable and healthcare expenses for the nine months ended September 30, was as follows:

| For the Nine Months Ended September 30, | ||||||||

| 2021 | 2020 | |||||||

| Claims Unpaid, Beginning of Year | $ | 56,934,400 | $ | 19,859,348 | ||||

| Incurred, Related to: | ||||||||

| Current Year | 418,149,443 | 295,275,661 | ||||||

| Prior Year(s) | (1,921,074 | ) | - | |||||

| Total Incurred | 416,228,369 | 295,275,661 | ||||||

| Paid, Related to: | ||||||||

| Current Year | 337,014,904 | 243,942,253 | ||||||

| Prior Year(s) | 61,039,614 | 19,038,200 | ||||||

| Total Paid | 398,054,518 | 262,980,453 | ||||||

| Claims Unpaid, End of Period | $ | 75,108,251 | $ | 52,154,556 | ||||

Total incurred claims of $416,228,369 and $295,275,661 for the nine months ended September 30, 2021 and 2020 respectively are lower than total Medical Expenses by $43,004,716 and $52,982,611 respectively. This difference is primarily composed of Medicare Part D expenses, Sub-Capitation expenses, and other non-claims payable medical expenses on the accompanying Condensed Consolidated Statements of Operations. Estimates for incurred claims are based on historical enrollment and cost trends while also taking into consideration operational changes. Future and actual results typically differ from estimates. Differences could result from an overall change in medical expenses per member, changes in member mix or simply due to the addition of new members.

Note 10: Long-Term Debt

In 2019, the Company received bridge loans (“LTD-A”) from some of its existing investors totaling $16,164,914. The bridge loans accrued interest at 12% and were scheduled to mature on November 12, 2019. All but one was repaid with proceeds raised from the issuance of Class D Units. The remaining and outstanding bridge loan balance was $1,629,310, plus accrued interest of $219,236 and was fully paid by November 30, 2020.

In 2019, the Company executed a share repurchase agreement with one of its investors (“LTD-C”). The agreement stipulated $15.0 million originally contributed by the investor would be repaid by the earlier of June 28, 2023 or a change in control transaction. As part of this repurchase agreement, the investor exchanged its owned units back for a $15.0 million note receivable from the Company – thus, no longer holding its former equity position. The note carries interest of 10.0% per year. Its principal balance plus accrued interest is due at maturity in 2023. Accrued interest was $5,316,338 and $3,865,740 at September 30, 2021, and December 31, 2020, respectively. The total principal balances are included in Long-Term Debt on the Company’s Condensed Consolidated Balance Sheets at September 30, 2021 and December 31, 2020.

24

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

On November 19, 2020, the Company entered a Term Loan and Security Agreement (the “Facility”) with a commercial lender (“LTD-D”). The Facility provides funding up to $100.0 million, of which $52.8 million has been drawn as of September 30, 2021. Of the $52.8 million drawn, $36.5 million was received on November 19, 2020 (net of $3.5 million in financing costs) and $12.6 million was received on June 28, 2021 (net of $0.2 million in financing costs). Financing costs are amortized on a straight-line basis through the Facility’s expected maturity date. The Facility may be used to pay certain indebtedness of the Company and for general working capital needs. The Company has access to an additional $47.3 million (of which $22.3 million may be drawn up through December 31, 2021 and $25.0 million, which may be drawn up through February 28, 2022). Repayment of principal of all amounts drawn are due at maturity.

The Company must meet a borrowing base milestone by demonstrating to the Lenders that revenue for any three consecutive month period (ending after the Facility’s closing date, but on or prior to December 31, 2021) is greater than or equal to $125.0 million. Additionally, the Company must remain in compliance with financial covenants such as minimum liquidity of $5.0 million and annual minimum revenue levels. For certain days in September 2021, minimum liquidity for the Company, as defined in the Agreement, fell below $5.0 million. The Company has obtained a waiver of the debt covenant violation that occurred on those days. Starting in 2021, and on an annual basis thereafter, the Company must post a minimum amount of annual revenue equal to, or greater than $395.0 million; increasing to $460.0 million in 2022; $525.0 million in 2023; $585.0 million in 2024 and $650.0 million in 2025. Also, the Company is subject to certain restrictions that include indebtedness and liens.

The Facility’s maturity date is December 31, 2025. This maturity date may be accelerated as a remedy under the certain default provisions in the agreement or in the event a mandatory prepayment trigger occurs. Interest is payable at 12.0% per annum on a quarterly cycle (in arrears) beginning March 31, 2021. Management may elect to pay the full 12.0% in cash or at 8.0% with the remaining 4.0% being added to principal as “paid in kind” (“PIK”) for a period of three years (or twelve payments). The PIK is subject to acceleration as of that date in the event certain occurrences in the Facility’s agreement are triggered. The Facility’s Lenders also received ten-year warrants to purchase 858,351 shares of Series D Preferred Units at $4.68 per share. These warrants have been recorded as a liability in the Company’s Condensed Consolidated Balance Sheets at fair market value and are marked to market on a quarterly basis until exercised. A discount was recorded on the debt issued for the same amount. The discount is amortized through maturity of the loan.

The Security Agreement provides the Lenders collateral in 100% of the Company’s pledged stock, its subsidiaries (including tangible and intangible personal property) and bank accounts.

On June 7, 2020, the Company repurchased 200,000 Class C (Time-based) Units, at $0.90 per Unit from a former Executive through issuance of a long-term note (“LTD-E”). This repurchase was recognized in the Company’s condensed consolidated balance sheets as a reduction to Members’ Deficit in the amount of $180,000 and a corresponding increase in Long term Debt. LTD-E bears interest of 3.25% and fixed monthly payments of $7,757 through date of maturity (June 7, 2022). At September 30, 2021, the remaining balance due on LTD-E has been recorded as Current Portion of Long-Term Debt in the Company’s Condensed Consolidated Balance Sheets given its maturity date is within 12-months.

25

P3 HEALTH GROUP HOLDINGS, LLC and SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2021 and 2020

The following table rolls forward the long-term debt balances presented in the Company’s Condensed Consolidated Balance Sheets:

| LTD-A | LTD-B | LTD-C | LTD-D | LTD-E | Totals | |||||||||||||||||||

| Balance at December 31, 2019 | $ | 1,516,598 | $ | - | $ | 15,000,000 | $ | - | $ | - | $ | 16,516,598 | ||||||||||||

| Issued in 2020 | - | - | - | 40,000,000 | 180,000 | 40,180,000 | ||||||||||||||||||

| Principal Payments in 2020 | (1,516,598 | ) | - | - | - | (43,911 | ) | (1,560,509 | ) | |||||||||||||||